Don't be tricked by fake car insurance

THE CONSEQUENCES ARE CRUSHING

Deal too good to be true? It probably is!

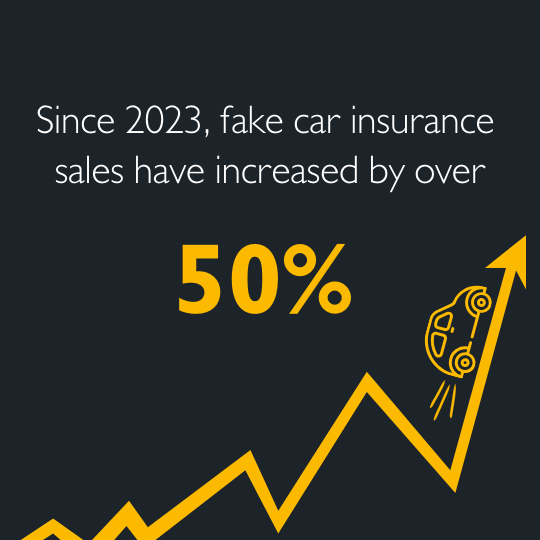

Bogus car insurance deals sold by fraudsters called ‘Ghost Brokers’ are growing on social media. Fall victim, and you’ll be out of pocket and breaking the law by driving uninsured!

Learn the signs of the scam and help spread the word!

There's been a big rise in bogus motor insurance deals being promoted on popular social media sites like Facebook, Instagram, SnapChat and TikTok.

Young drivers, including those getting their first car, and learners who need learner cover, are most at risk of being targeted and the policies are completely worthless!

The consequences of driving on fake cover are devastating. Your car can be seized and potentially crushed by police. You'll get an instant £300 fine and 6 licence points. You could be taken to court where you can get a driving ban and/or an unlimited fine.

Have you been offered an unrealistic car insurance deal? Always do your checks.

Avoid Ghost Broker scams

What is a Ghost Broking scam?

Ghost Brokers are fraudsters pretending to be insurance brokers. They promote bogus car insurance deals on social media and sometimes on fake insurer websites, and target young drivers with unrealistically cheap policies.

A red flag could be that they promise the lowest rate on the market, even if the driver has convictions - and they'll even offer up-front quotes, despite the fact car insurance is meant to be priced based on the risk of the individual.

The fraudster often then encourages further discussion through encrypted messaging apps like WhatsApp to arrange payment and keep illegal dealings in private.

The policies are usually taken out using stolen personal information, which is how they've been sold on at a reduced rate, or they may be a photoshopped piece of paper; in both instances, the policy is still invalid and the victim is driving uninsured.

Seen a dodgy deal? Trust your suspicions: avoid it and report it to CheatLine.

DON'T GET CAUGHT OUT

How to spot a Ghost Broker

Know the signs

- The price is much better than you can find anywhere else.

- The seller only wants to communicate via social media or a messaging app (eg Whatsapp or Snapchat).

- The seller is vague about how they're getting you such a good price.

- The seller doesn't have a legitimate website, UK landline number or address.

Do your checks

- If buying through a broker, check they're registered with British Insurance Brokers' Association (BIBA). Check here...

- If buying directly through an insurer, check they're a member of Motor Insurers' Bureau (MIB). Check here...

- Whether broker or insurer, check they're registered with the Financial Conduct Authority (FCA). If they're not, avoid using them! Check here...

Know the consequences

- Your car may be seized and crushed.

- There is a £300 fixed penalty notice.

- You may get six points on your driving licence.

- You face the cost of retrieving your impounded vehicle... if it's not been crushed.

- You face the cost of buying a new, valid insurance policy.

- There may be court action resulting in a criminal record, an unlimited fine and a driving ban.

- You may be personally liable for your own and any third-party claims costs.

This awareness campaign is supported by:

I've checked and my insurance is all legit...

Great! Drive on and mind how you go.

Keep an eye out for suspicious ads on social media and report anything you see to IFB's Cheatline online or call 0800 422 0421.

By helping us reduce fraud you can help lower insurance premiums and keep our roads safe.

I've been caught out or seen a scam online...

Report it!

If you know or suspect someone of committing insurance fraud, report it via IFB's Cheatline online or call 0800 422 0421.

It should also be reported to the police via Action Fraud online or call 0300 123 2040.

By helping us reduce fraud you can help lower insurance premiums and keep our roads safe.

I want to know how IFB tackles Ghost Broking...

As the counter fraud intelligence hub for the insurance industry, we share the information you provide securely with insurers, the police and industry watchdogs, helping to protect the honest majority.

Read how we uncovered one fraudster who sold hundreds of fake policies.